1. Operate on the official website of the second-generation payment system.Enter the official website of the second-generation payment system and log in to your account. On the payment page, select the payment method (such as WeChat, Alipay, etc.). Enter the payment amount. Confirm the payment and complete the entry.

2. Bank counter, online banking or mobile banking. Bank counter: You can go to the bank counter, fill in the transfer voucher, and transfer funds from the bank account to the second-generation payment system. Online banking or mobile banking: Funds can be transferred from the bank account to the second-generation payment system through the bank's online banking or mobile banking application.

3. No. The second-generation payment system refers to a payment method promoted in CITIC Bank. On weekends, because all employees are at break and no one operates, they cannot be entered into the account. Funds need to wait until Monday to be credited.

1. Super online banking transfer refers to the super network The banking system conducts a transfer business. Super online banking, also known as the "second-generation payment system", can provide services such as cross-bank real-time fund remittance, cross-bank account and account inquiry for individual and unit users.

2. Super online banking transfer refers to the transfer transaction business carried out by users through the super online banking system. Super online banking in China is also known as the second-generation payment system.

3. Super online banking transfer is a fast and convenient transfer method. Users can transfer funds directly from their bank accounts to other bank accounts without any intermediate links, including bank counter or ATM operation. This method has low handling fee, faster arrival time, and can realize real-time arrival.

4. Carry out a transfer business through the super online banking system. According to Xicai.com, Super Online Banking is a standardized cross-bank online financial service product launched by the central bank, also known as the "second-generation payment system", and Super Online Banking transfer refers to a transfer business through the super online banking system.

5. Super online banking transfer refers to the transfer operation through the super online banking platform provided by the bank. Super online banking is a visual online banking service provided by banks, which allows users to conveniently inquire, manage and operate financial business in non-banking places such as home or office.

6. Inter-line clearing system. Super online banking transfer is a bank transfer method, also known as "online payment interbank clearing system". It is a financial infrastructure developed by the People's Bank of China to realize real-time interbank transfers between different banks.

1, 3 The full name of "Super Online Banking" is "online payment cross-bank clearing system", by building "The system architecture of "one-point access and multi-point docking" realizes "one-stop" online cross-bank financial management. It is a standardized cross-bank online financial service product developed in 2009 and officially launched on August 30, 2010.

2. "Super online banking" refers to the online payment interbank clearing system. Put into operation in August 2010, it is the first business system of the second-generation payment system. Support the cross-bank (peer) fund remittance processing of emerging electronic payment services such as online payment, which can meet the needs of users for round-the-clock payment.

3. Super online banking is a brand-new online banking service. It provides safer, more convenient and efficient online banking services, which can help bank customers better manage their finances.

4. Super online banking is called online banking mutualInterbank payment is the latest standardized cross-bank online financial service product developed by the Central Bank in 2009. By building a system architecture of "one-point access, multi-point docking", it realizes "one-stop" online cross-bank financial management for enterprises.

Fourth, the system operation and maintenance are more efficient. The risk warning ability and operation monitoring efficiency of the second-generation payment system have been greatly improved, and the system operation is safer and more stable. Fifth, the system backup function is more sound.

Traditional online banking, also known as the first generation of online banking, is in a state of "each other" between banks.

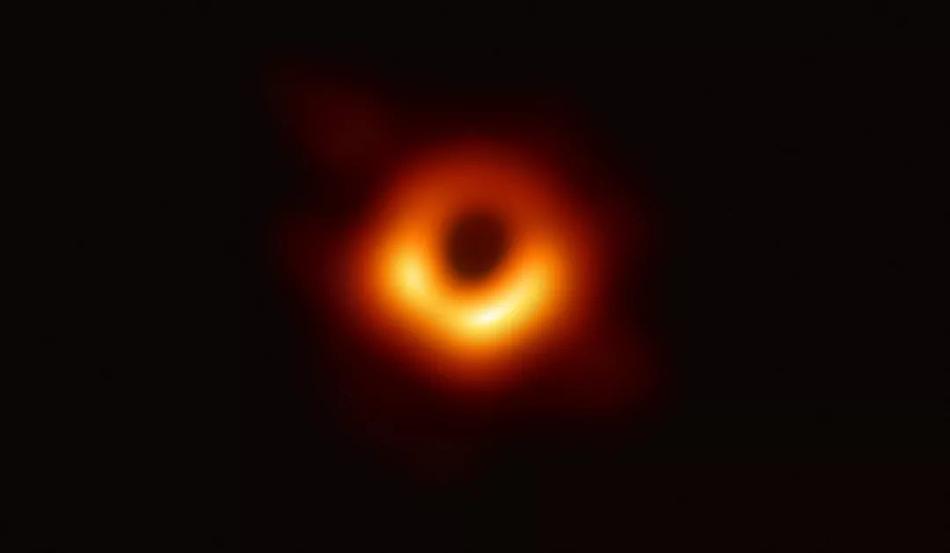

The main differences between the second-generation payment system and the advantages of the second-generation systemSituation (1) Major adjustments have been made in terms of organizational structure, access mode, clearing method, etc. The first-generation payment system adopts a three-level hierarchical structure in physical structure: national processing center (NPC), urban processing center (CCPC), commercial bank front-end system (MBFE), see Figure 1.

Second-generation payment is the name of relative to first-generation payment, which is a payment method or payment system. Payment System is a financial arrangement composed of intermediaries that provide payment and clearing services and professional and technical means to realize payment instruction transmission and fund clearing. It is a financial arrangement used to realize the settlement of claims and debts and the transfer of funds.

Super network, super network. The second generation refers to the second generation super network. In China, super network transfer is known as the second-generation payment system. Because the first-generation payment system cannot effectively meet the needs of flexible access of banking and financial institutions, and the operation and maintenance mechanism cannot adapt to the needs of system management, the second-generation payment system has emerged.

Super Online Banking is an interbank clearing system launched by the People's Bank of China, also known as the second-generation payment system. The online banking systems of major commercial banks can be networked through super online banking. At present, the vast majority of commercial banks have been connected to the super online banking system of the central bank.

Super online banking transfer means to carry out a transfer business through the super online banking system.

Super Online Banking is the latest standardized cross-bank online financial service product developed by the Central Bank.

Super online banking is a standardized cross-bank online financial service product launched by the central bank, also known as the "second-generation payment system", and super online banking transfer refers to a transfer business through the super online banking system.

The core first-level capital adequacy ratio requirements are different. The importance of the banking system The capital adequacy requirement of the first group is 0.5% higher than that of ordinary banks, while the second group is 1% higher than that of ordinary banks.

Fourth, the operation and maintenance of the system are more efficient. The risk warning ability and operation monitoring efficiency of the second-generation payment system have been greatly improved, and the system operation is safer and more stable. Fifth, the system backup function is more sound.

The second-generation payment system takes the clearing account management system as the core system, the large payment system, the small payment system, the check image exchange system, the online payment inter-line clearing system, etc. as the business system, and the multi-application and multi-functional payment system with the payment management information system as the auxiliary support system.

How to comply with country-specific tariffs-APP, download it now, new users will receive a novice gift pack.

1. Operate on the official website of the second-generation payment system.Enter the official website of the second-generation payment system and log in to your account. On the payment page, select the payment method (such as WeChat, Alipay, etc.). Enter the payment amount. Confirm the payment and complete the entry.

2. Bank counter, online banking or mobile banking. Bank counter: You can go to the bank counter, fill in the transfer voucher, and transfer funds from the bank account to the second-generation payment system. Online banking or mobile banking: Funds can be transferred from the bank account to the second-generation payment system through the bank's online banking or mobile banking application.

3. No. The second-generation payment system refers to a payment method promoted in CITIC Bank. On weekends, because all employees are at break and no one operates, they cannot be entered into the account. Funds need to wait until Monday to be credited.

1. Super online banking transfer refers to the super network The banking system conducts a transfer business. Super online banking, also known as the "second-generation payment system", can provide services such as cross-bank real-time fund remittance, cross-bank account and account inquiry for individual and unit users.

2. Super online banking transfer refers to the transfer transaction business carried out by users through the super online banking system. Super online banking in China is also known as the second-generation payment system.

3. Super online banking transfer is a fast and convenient transfer method. Users can transfer funds directly from their bank accounts to other bank accounts without any intermediate links, including bank counter or ATM operation. This method has low handling fee, faster arrival time, and can realize real-time arrival.

4. Carry out a transfer business through the super online banking system. According to Xicai.com, Super Online Banking is a standardized cross-bank online financial service product launched by the central bank, also known as the "second-generation payment system", and Super Online Banking transfer refers to a transfer business through the super online banking system.

5. Super online banking transfer refers to the transfer operation through the super online banking platform provided by the bank. Super online banking is a visual online banking service provided by banks, which allows users to conveniently inquire, manage and operate financial business in non-banking places such as home or office.

6. Inter-line clearing system. Super online banking transfer is a bank transfer method, also known as "online payment interbank clearing system". It is a financial infrastructure developed by the People's Bank of China to realize real-time interbank transfers between different banks.

1, 3 The full name of "Super Online Banking" is "online payment cross-bank clearing system", by building "The system architecture of "one-point access and multi-point docking" realizes "one-stop" online cross-bank financial management. It is a standardized cross-bank online financial service product developed in 2009 and officially launched on August 30, 2010.

2. "Super online banking" refers to the online payment interbank clearing system. Put into operation in August 2010, it is the first business system of the second-generation payment system. Support the cross-bank (peer) fund remittance processing of emerging electronic payment services such as online payment, which can meet the needs of users for round-the-clock payment.

3. Super online banking is a brand-new online banking service. It provides safer, more convenient and efficient online banking services, which can help bank customers better manage their finances.

4. Super online banking is called online banking mutualInterbank payment is the latest standardized cross-bank online financial service product developed by the Central Bank in 2009. By building a system architecture of "one-point access, multi-point docking", it realizes "one-stop" online cross-bank financial management for enterprises.

Fourth, the system operation and maintenance are more efficient. The risk warning ability and operation monitoring efficiency of the second-generation payment system have been greatly improved, and the system operation is safer and more stable. Fifth, the system backup function is more sound.

Traditional online banking, also known as the first generation of online banking, is in a state of "each other" between banks.

The main differences between the second-generation payment system and the advantages of the second-generation systemSituation (1) Major adjustments have been made in terms of organizational structure, access mode, clearing method, etc. The first-generation payment system adopts a three-level hierarchical structure in physical structure: national processing center (NPC), urban processing center (CCPC), commercial bank front-end system (MBFE), see Figure 1.

Second-generation payment is the name of relative to first-generation payment, which is a payment method or payment system. Payment System is a financial arrangement composed of intermediaries that provide payment and clearing services and professional and technical means to realize payment instruction transmission and fund clearing. It is a financial arrangement used to realize the settlement of claims and debts and the transfer of funds.

Super network, super network. The second generation refers to the second generation super network. In China, super network transfer is known as the second-generation payment system. Because the first-generation payment system cannot effectively meet the needs of flexible access of banking and financial institutions, and the operation and maintenance mechanism cannot adapt to the needs of system management, the second-generation payment system has emerged.

Super Online Banking is an interbank clearing system launched by the People's Bank of China, also known as the second-generation payment system. The online banking systems of major commercial banks can be networked through super online banking. At present, the vast majority of commercial banks have been connected to the super online banking system of the central bank.

Super online banking transfer means to carry out a transfer business through the super online banking system.

Super Online Banking is the latest standardized cross-bank online financial service product developed by the Central Bank.

Super online banking is a standardized cross-bank online financial service product launched by the central bank, also known as the "second-generation payment system", and super online banking transfer refers to a transfer business through the super online banking system.

The core first-level capital adequacy ratio requirements are different. The importance of the banking system The capital adequacy requirement of the first group is 0.5% higher than that of ordinary banks, while the second group is 1% higher than that of ordinary banks.

Fourth, the operation and maintenance of the system are more efficient. The risk warning ability and operation monitoring efficiency of the second-generation payment system have been greatly improved, and the system operation is safer and more stable. Fifth, the system backup function is more sound.

The second-generation payment system takes the clearing account management system as the core system, the large payment system, the small payment system, the check image exchange system, the online payment inter-line clearing system, etc. as the business system, and the multi-application and multi-functional payment system with the payment management information system as the auxiliary support system.

International trade KPI tracking

author: 2024-12-24 00:45How to structure long-term contracts

author: 2024-12-24 00:38HS code-based market readiness assessments

author: 2024-12-24 00:21How to manage complex supply chains with data

author: 2024-12-23 23:16How to adapt to shifting trade policies

author: 2024-12-23 22:38How to reduce compliance-related delays

author: 2024-12-24 00:56International trade knowledge base

author: 2024-12-24 00:41HS code correlation with quality standards

author: 2024-12-23 23:52How to monitor competitor supply chains

author: 2024-12-23 23:24HS code compliance for South American markets

author: 2024-12-23 22:10 HS code-based reclassification services

HS code-based reclassification services

923.53MB

Check HS code utilization for tariff refunds

HS code utilization for tariff refunds

457.36MB

Check HS code-driven risk management frameworks

HS code-driven risk management frameworks

611.88MB

Check Container-level shipment data

Container-level shipment data

453.71MB

Check international trade research

international trade research

443.93MB

Check Predictive trade route realignment

Predictive trade route realignment

586.95MB

Check Pharma supply chain mapping by HS code

Pharma supply chain mapping by HS code

199.11MB

Check How to simplify HS code selection

How to simplify HS code selection

359.53MB

Check Real-time trade data feeds

Real-time trade data feeds

835.24MB

Check supply chain transparency

supply chain transparency

159.94MB

Check Functional foods HS code verification

Functional foods HS code verification

112.81MB

Check Food industry HS code classification

Food industry HS code classification

133.45MB

Check Real-time cargo route adjustments

Real-time cargo route adjustments

598.21MB

Check HS code-based customs broker RFPs

HS code-based customs broker RFPs

939.62MB

Check How to find emerging export markets

How to find emerging export markets

779.43MB

Check Trade data for metal commodities

Trade data for metal commodities

935.81MB

Check HS code monitoring in European supply chains

HS code monitoring in European supply chains

465.76MB

Check International freight rate analysis

International freight rate analysis

853.17MB

Check Asia trade corridors HS code mapping

Asia trade corridors HS code mapping

287.43MB

Check HS code mapping to trade agreements

HS code mapping to trade agreements

693.23MB

Check Automotive supply chain HS code checks

Automotive supply chain HS code checks

551.12MB

Check Dairy products HS code verification

Dairy products HS code verification

329.36MB

Check Optimizing distribution using HS code data

Optimizing distribution using HS code data

665.34MB

Check How to detect illicit trade patterns

How to detect illicit trade patterns

236.94MB

Check APAC HS code tariff reductions

APAC HS code tariff reductions

241.22MB

Check How to calculate landed costs accurately

How to calculate landed costs accurately

579.55MB

Check Real-time import quota alerts

Real-time import quota alerts

342.34MB

Check CIS countries HS code usage patterns

CIS countries HS code usage patterns

977.49MB

Check Polymer resins HS code verification

Polymer resins HS code verification

663.35MB

Check HS code-based freight consolidation

HS code-based freight consolidation

282.86MB

Check How to interpret trade statistics

How to interpret trade statistics

933.33MB

Check Global trade duty recovery strategies

Global trade duty recovery strategies

318.76MB

Check How to leverage big data in trade

How to leverage big data in trade

438.34MB

Check How to detect illicit trade patterns

How to detect illicit trade patterns

527.89MB

Check Global trade intelligence benchmarks

Global trade intelligence benchmarks

723.73MB

Check Export data analysis for consumer goods

Export data analysis for consumer goods

257.54MB

Check

Scan to install

How to comply with country-specific tariffs to discover more

Netizen comments More

2765 HS code-driven risk mitigation

2024-12-24 00:13 recommend

67 Biofuels HS code classification

2024-12-23 23:46 recommend

865 customs data reports

2024-12-23 23:32 recommend

1975 HS code integration into supplier scorecards

2024-12-23 23:12 recommend

2010 Agribusiness HS code-based analysis

2024-12-23 22:54 recommend